Russia’s credit performance has finally stabilised after a notable four-year decline, according to new data out today from FICO.

Russia’s credit performance has finally stabilised after a notable four-year decline, according to new data out today from FICO.

Top Results:

- FICO® Credit Health Index for Russia has stabilised following a four-year slide

- 16 percent of Russian credit accounts are delinquent, more than twice as many as in January 2012

- FICO Credit Health Index measures the percentage of delinquent consumer loans and credit cards reported to NBKI, Russia’s largest credit bureau

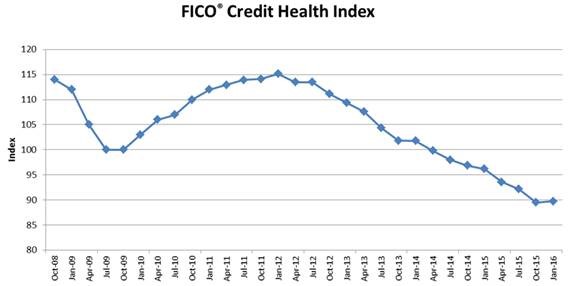

The deteriorating credit performance of Russian consumers has stabilised following a four-year slide, according to data from analytic software company FICO and National Bureau of Credit Histories (NBKI), Russia’s leading credit bureau. The FICO® Credit Health Index, which has fallen steadily since January 2012, has remained at its low point since September 2015. The index stands at 90 points, 1 point higher than in October 2015 but 6 points lower than January 2015 and 25 points lower than the peak in January 2012.

The FICO Credit Health Index measures Russia’s overall credit health, based on the percentage of consumer loans and credit cards reported to NBKI that are delinquent by more than 60 days. The January index means that 16 percent of Russian credit accounts were delinquent, compared with the same rate three months ago, 13 percent one year ago and just 7.1 percent in January 2012.

Source: FICO and NBKI

Every one of the eight federal regions tracked is below the benchmark score of 100, established in October 2008, and most regions fell since October 2015. The average drop since the peak in January 2012 has been 27 points, with Severo-Kavkazskii experiencing the largest drop of 35 points and Centralnyi experiencing the smallest drop of 21 points. The regions Centralnyi (index 94), Severo-Zapadnyi (index 94) and Privoljskii (index 92) are the only regions outperforming the total population index.

“We are no longer seeing the sharp rise in delinquencies in Russian credit accounts,” said Evgeni Shtemanetyan, who directs FICO’s operations in Russia. "The growth in credit card lending initially increased the amount of risk throughout the financial system, and now we are seeing some stability. However, it remains important for Russian credit risk managers to follow best practices in managing consumers who now have higher levels of unsecured debt.”

“Banks lowered their risk appetite some time ago, and we are starting to see the effect on the index,” said Alexander Vikulin, CEO of NBKI. “However, lenders still need to deal with higher-risk accounts booked previously. This is why account monitoring and risk management are so vital.”

FICO and NBKI share this data with Russian lenders to improve their understanding of the credit market, and help them extend credit to consumers safely and profitably. More than half of the top Russian banks use FICO® Scores delivered by NBKI.